Nvidia Stock — Deep Dive: Forecasts, Risks, and What Investors Should Know

What is Nvidia Stock & Why It Matters

NVIDIA Corporation (ticker NVDA) has become one of the marquee names in the technology sector, particularly since the rise of artificial intelligence. Its GPUs power major AI models, cloud/datacenter infrastructure, gaming, autonomous vehicles, etc. Investors pay attention to Nvidia stock not just for growth, but for how it reflects broader trends: AI demand, export controls, supply chain dynamics, and geopolitics (especially U.S.–China relations).

Recent Performance / Earnings Warning

Nvidia’s recent earnings reports have been strong, but there are warnings investors should heed.

In its first fiscal quarter of 2026 (ended April 27, 2025), Nvidia reported revenue of $44.1 billion, up 69% year-over-year.

However, it also incurred a $4.5 billion charge related to export licensing restrictions tied to its H20 product and slowed demand from China.

KeyBanc and other analysts recently raised earnings warnings, noting that guidance may come in short of lofty expectations because of China exposure and export restrictions.

These earnings warnings suggest that while growth remains, there are near-term headwinds, particularly from regulation & international market risk.

Nvidia Stock and China: Geopolitical & Trade Risks

China remains a crucial and yet challenging piece of Nvidia’s growth story.

New U.S. export restrictions require licensing for the sale of certain Nvidia AI chips into China, particularly affecting revenue from the H20 line.

The Chinese regulator (CAC) has ordered domestic tech firms to stop buying some Nvidia chips and cancel orders (e.g. RTX Pro 6000D, etc.) amid concerns about U.S. technology dependence.

The loss of China demand is estimated in billions — Nvidia expects several billions of dollars in lost revenue due to these restrictions.

Therefore, nvidia stock china risk is real and must be factored into any forecast or investment decision.

Will There Be Another Nvidia Stock Split? / Nvidia Stock Split Date / Split Announcement

Stock splits often attract attention because they make shares more accessible to retail investors, but do not change the overall value of an investor’s holdings. Let’s review Nvidia’s history and what might be ahead.

History of Nvidia Stock Splits

On May 22, 2024, Nvidia announced a 10-for-1 forward stock split.

The split was effective June 7, 2024, and shares traded on a split-adjusted basis starting June 10, 2024.

Will Nvidia Stock Split Again in 2024 or 2025?

There is no confirmed announcement of another stock split in 2025 at the time of this writing. Most recent data and filings do not show a new split date beyond the one in 2024.

The phrase “nvidia stock split potential” shows up in speculation, but credible sources so far are not confirming a new split.

What Does the 2024 Split Mean for Investors?

The 2024 split lowered the price per share, making Nvidia more affordable for smaller investors without changing market cap.

Options and derivatives were adjusted accordingly.

Understanding when is nvidia stock split date or when will nvidia stock split is important if you are trading around ex-split dates (though the last one is in the past).

Forecasts & Predictions: 2030, 2040, and Beyond

Investors often ask “what will nvidia stock be worth in 5 years,” or even by 2030 or 2040. Let’s synthesize multiple projections and scenarios.

Nvidia Stock Price Prediction 2030

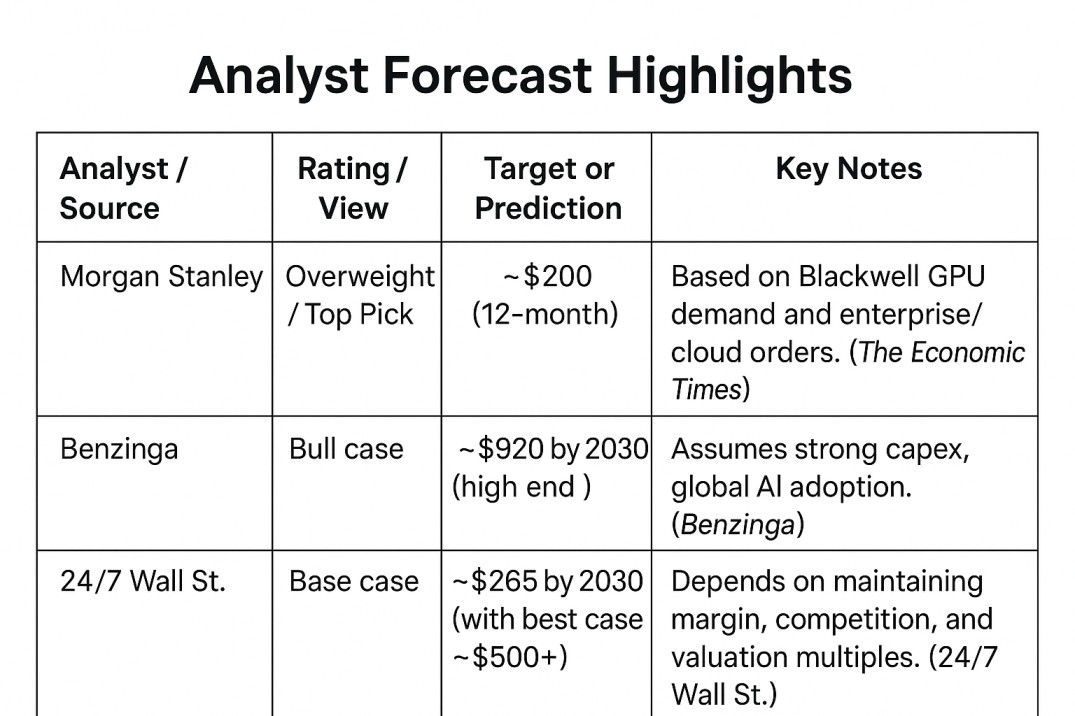

According to sources like Benzinga, the average forecast for NVDA by 2030 ranges from roughly $800-$920 per share in bullish / base case scenarios.

Other forecasts (e.g. 24/7 Wall St.) are more conservative: NVDA price target ~ $265.35 by end of 2030 in base case, with high‐end scenario up to $500+ if growth, margins, and multiple expansion all align.

Nvidia Stock Forecast 2040

Beyond 2030, predictions are more speculative. Few credible forecasts extend as far as 2040, but in those, Nvidia is expected to continue benefiting from compounding demand in AI, data centers, autonomous systems, etc. A scenario where NVDA becomes a trillion-dollar revenue business could push its stock price much higher — but discount‐rate risk, competition, regulation, and tech disruption must be considered.

What Drives These Forecasts?

Strong capital expenditure (capex) budgets in datacenter, cloud AI, sovereign AI, etc. Nvidia’s investment in new chip architectures (e.g Blackwell) also supports upside.

Growth in AI, especially “inference” and model deployment, where Nvidia’s hardware + software stack has competitive advantage.

Risks from export controls, competition (AMD, Intel, Chinese chipmakers) and valuation multiples being high.

Analyst Ratings & Options: Is It a Buy, Hold, or Sell?

Buy Rating Morgan Stanley

Morgan Stanley recently raised its 12-month price target for Nvidia to ~$200 (from ~$170), reaffirming its “top pick” status among semiconductor stocks. The firm cited exceptional demand for Blackwell chips and strong enterprise/cloud backlog.

In earlier reports, Morgan Stanley had also given NVDA an “overweight” rating.

Nvidia Stock Options

For those trading options, volatility around earnings, trade/China risk, and split adjustments matter. The 2024 stock split required options contract adjustments.

Investors using call/put options might bet on near-term headwinds (e.g. China licensing, earnings warning) vs long-term upside (AI expansion).

Is Nvidia Stock a Good Buy? / Should I Buy or Sell NVDA?

Should I buy Nvidia stock / Should you buy Nvidia stock? If you have a long horizon (5-10+ years) and believe in sustained AI, then many analysts think yes.

Should I sell my Nvidia stock now? Some might consider taking profits or hedging because of high valuation, geopolitical risk, or upcoming regulatory challenges.

Risks & Potential Declines

Even though NVDA is widely seen as a leader, there are several risk factors that could lead to nvidia stock potential decline:

Regulatory risk: Export control, especially regarding China, could cut into a sizable revenue stream.

Competition: AMD, Intel, Chinese companies pushing hard. If they produce competitive AI chips or if open-source / custom chips reduce dependence on Nvidia, margins may be pressured.

Earnings warning: If Nvidia misses guidance or fails to meet extraordinarily high expectations, stock may drop sharply.

Valuation risk: With P/E multiples elevated, there’s little margin for error.

There’s also the chance that nvidia stock drop meme content (viral negativity) triggers short-term volatility.

Nvidia Stock Forecast & Technical Analysis May 2025

According to CoinCodex, NVDA stock forecast for short term (e.g. into late 2025) sees modest uptick ~$188-190 per share by October 2025, assuming current sentiment remains bullish.

Wall Street consensus and technical indicators show mixed signals: some overbought conditions, strong momentum, but also risk that any negative China news or earnings warning could trigger pullback.

Analyst Forecast Highlights

Verdict: Should You Buy or Sell Nvidia Stock Now?

If you are a long-term investor (5-10+ years), with capacity to handle volatility, NVDA remains one of the most compelling plays in AI infrastructure. The upside is meaningful in many forecast scenarios.

If you are a short-term trader, you should pay close attention to export/licensing updates (especially related to China), competitor moves, upcoming earnings (and guidance), and macro/regulatory risk.

If you already own Nvidia, perhaps consider partial hedging or taking profits if your cost basis is low and valuation seems rich.

Final Thoughts

Nvidia stock is at a fascinating crossroads in late 2025. On one hand, AI demand is accelerating globally, Nvidia remains at the frontline, and forecasts through 2030 and even 2040 show very large potential upside. On the other hand, valuation is rich, risks (especially with China and export licensing) are nontrivial, and short-term earnings warnings could trigger price volatility.

If you’re considering investing, ask yourself:

What is your time horizon?

How much risk are you willing to tolerate?

Do you believe global AI adoption (including in China / Asia / emerging markets) will continue unabated?

Can you afford to hold through regulatory/market dips?

If your answer is yes, then Nvidia is likely still a good buy for many portfolios. Just be mindful of risk, use diversification, and perhaps consider options or other hedges to protect downside.

FAQs: Your Top Questions Answered

Is it too late to buy Nvidia stock?

If you believe AI disruption will continue for years, and you can tolerate volatility, it may not be too late. But buying now means valuation is high, so future returns might be lower (especially in short term).

Will Nvidia stock go up after the split?

Past splits (like the 2024 10-for-1) did increase liquidity and investor interest. But splits themselves don’t change fundamentals. So upwards movement depends on earnings, growth, demand — not just the split.

Will Nvidia stock reach $1,000?

Some predictions for 2030 (bull case) suggest that could happen in high-growth, high multiple scenarios but that would require sustained growth, margin expansion, favorable regulatory environment, and low competition. Probably not guaranteed.

What about Nvidia stock price forecast 2030 & 2040?

As above — price targets by 2030 vary widely: base case from ≈ $200-$300 up to ~$800-$1,000+, depending on assumptions. For 2040, more speculative: if Nvidia captures large parts of AI infrastructure, maybe multiples higher, revenues much larger, but discount rates, tech shifts may reduce value.

Is Nvidia stock buy rating Morgan Stanley still valid?

Morgan Stanley has maintained NVDA as a top pick, and recently raised its target price. So yes — according to that firm. But different analysts may have different views.